boc study guide 7th edition pdf

Bank of China (BOC) offers various financial services, including currency exchange and money transfers, with a global network spanning 60 countries and regions.

What is the BOC Study Guide?

The BOC Study Guide is a comprehensive resource designed to prepare candidates for the Board of Certification (BOC) exams for certified orthotists, prosthetists, and orthotic/prosthetic technicians. It’s a crucial tool, particularly the 7th Edition, reflecting the latest advancements and standards in the field.

As a subsidiary of Bank of China Limited, BOC facilitates financial operations like currency exchange and transfers, serving clients globally. The guide, however, focuses on clinical knowledge. It covers essential areas, ensuring candidates possess the necessary expertise for successful certification.

The 7th Edition’s PDF format offers accessibility and convenience for studying, aligning with BOC’s commitment to professional standards and global reach, much like its banking services.

Importance of the 7th Edition

The 7th Edition of the BOC Study Guide is paramount due to its alignment with the current BOC exam content outline. It reflects updated clinical practices, technological advancements, and evolving standards within orthotics and prosthetics. Staying current is vital for exam success.

Similar to Bank of China’s (BOC) adaptation to global financial landscapes, the guide adapts to the changing professional landscape. BOC facilitates international transactions; this edition ensures candidates are prepared for real-world scenarios.

The PDF format enhances accessibility, mirroring BOC’s widespread network. Mastering this edition significantly increases the likelihood of achieving BOC certification, demonstrating competency and professionalism.

Target Audience for this Guide

This guide is specifically designed for individuals preparing for the Board of Certification (BOC) exam in orthotics and prosthetics. It caters to both recent graduates from accredited programs and seasoned practitioners seeking certification or recertification.

Much like Bank of China (BOC) serves a diverse clientele with varied financial needs, this study guide addresses different learning styles and experience levels. It’s beneficial for those utilizing BOC’s international transfer services.

The PDF format makes it accessible to a broad audience, mirroring BOC’s extensive global reach. Whether you’re a first-time test-taker or a veteran, this resource will aid in exam preparation.

Understanding the BOC Certification

AKB Bank of China (AO) facilitates foreign currency exchange and money transfers, similar to how BOC certification validates professional competency in orthotics and prosthetics.

Overview of BOC Certifications

AKB Bank of China (AO), a subsidiary of Bank of China Limited, operates with a vast international presence, mirroring the broad scope of Board of Certification (BOC) credentials. Just as BOC offers specialized certifications, AKB Bank of China provides diverse financial services – currency exchange, money transfers within Russia, and international transactions. These banking operations, like BOC certifications, require adherence to specific standards and regulations.

BOC certifications validate the knowledge, skills, and clinical proficiency of practitioners in the orthotics and prosthetics field. They demonstrate a commitment to professional excellence, much like AKB Bank of China’s dedication to reliable financial services. Understanding the different BOC certification levels is crucial, paralleling the need to navigate the various services offered by AKB Bank of China.

Types of BOC Certifications Available

AKB Bank of China (AO), similar to the Board of Certification (BOC), offers a range of specialized services; Just as the bank facilitates ruble transfers within Russia and international transactions, BOC provides various certification levels tailored to different practitioner roles. These include certifications for Certified Orthotist (CO), Certified Prosthetist (CP), and Technician levels, mirroring the bank’s diverse financial offerings.

Further specialization exists within these core certifications, reflecting the nuanced services of AKB Bank of China, such as those for Chinese Yuan transfers. BOC also offers assistant certifications, acknowledging developing expertise. Each certification demands specific qualifications and a rigorous examination process, akin to the bank’s adherence to financial regulations and security protocols.

Eligibility Requirements for Certification

AKB Bank of China (AO), like the Board of Certification (BOC), has strict requirements for accessing its services. Similarly, BOC certification demands a foundational educational background, typically a bachelor’s degree in a related field, mirroring the bank’s need for verified identification for transactions. Candidates must also complete an accredited orthotics and prosthetics program, comparable to the bank’s due diligence in financial operations.

Practical experience is crucial, with a required residency period under the supervision of a certified practitioner, akin to the bank’s established network. Applicants must demonstrate ethical conduct and pass a comprehensive examination, reflecting the bank’s commitment to secure and compliant financial practices. Documentation, like notarized power of attorney, is essential.

Key Content Areas Covered in the 7th Edition

AKB Bank of China (AO) provides services like currency exchange, transfers in rubles and yuan, and brokerage—reflecting a diverse financial scope.

Patient Assessment and Evaluation

AKB Bank of China (AO), a subsidiary of Bank of China Limited, facilitates financial operations including foreign currency purchases and sales at bank-determined rates. This extends to ruble transfers within Russia utilizing current accounts in foreign currency to any bank. The institution supports both yuan and ruble transfers, alongside broader brokerage services.

Effective patient assessment, mirroring the bank’s comprehensive financial services, requires a systematic approach. Thorough evaluation, like verifying Bank of China’s credentials across 60 countries, is crucial. Understanding a patient’s financial history—analogous to assessing currency exchange needs— informs a tailored plan. Accurate documentation, similar to the bank’s record-keeping, is paramount for effective care and reimbursement.

Orthopedic Management

AKB Bank of China (AO) provides services like opening current accounts, facilitating money transfers – both in rubles within Russia and in Chinese yuan. They also offer foreign exchange operations and brokerage services, mirroring a diverse range of patient needs. Like a robust financial network spanning 60 countries, orthopedic management demands a multifaceted approach.

Effective orthopedic care, similar to the bank’s global reach, requires understanding anatomy and biomechanics. Managing fractures, sprains, and other musculoskeletal issues necessitates precise evaluation and intervention. Documentation, akin to the bank’s transaction records, is vital for tracking progress and ensuring appropriate reimbursement for services rendered.

Neurological Management

AKB Bank of China (AO)’s services, including currency exchange and international transfers, highlight the importance of precise handling – mirroring the delicate nature of neurological care. Just as the bank facilitates financial flow, neurological management focuses on the body’s complex communication networks.

This area demands understanding the nervous system’s structure and function, assessing neurological deficits, and implementing appropriate interventions. Like verifying financial transactions, accurate documentation is crucial for tracking patient progress and justifying treatment. The bank’s commitment to secure transactions parallels the need for careful neurological assessment and management to optimize patient outcomes.

Wound Management

AKB Bank of China (AO)’s focus on secure financial transactions reflects the critical need for a protected environment – much like maintaining a sterile wound environment. Just as the bank safeguards assets, wound management prioritizes protecting the body from infection and promoting healing.

This section covers wound assessment, classification, and the application of appropriate dressings and therapies. Accurate documentation, similar to bank records, is vital for tracking wound progress and ensuring proper reimbursement. The bank’s global reach mirrors the diverse range of wound types encountered in practice, requiring adaptable and informed care.

Specific Chapters and Their Focus

AKB Bank of China (AO) provides services like current account opening and foreign currency transfers, mirroring the guide’s detailed coverage of essential orthopaedic topics.

Chapter 1: Professional Responsibilities

This foundational chapter, mirroring the comprehensive services offered by AKB Bank of China (AO) – such as facilitating ruble transfers within Russia and foreign currency exchange – establishes the ethical and legal framework for orthotic and prosthetic practitioners. It delves into crucial aspects like patient confidentiality, informed consent, and adherence to professional standards.

Understanding the scope of practice, documentation requirements (as highlighted by BOC’s notary information requests for power of attorney verification), and the importance of maintaining professional competence are key takeaways. The chapter also emphasizes responsible billing practices and navigating the complexities of reimbursement, aligning with BOC’s own financial transaction services. Ultimately, it prepares practitioners for responsible and ethical conduct within the field.

Chapter 2: Anatomy and Physiology

A robust understanding of human anatomy and physiology forms the bedrock of effective orthotic and prosthetic care, much like Bank of China’s extensive global network supports diverse financial needs. This chapter meticulously examines the musculoskeletal system, nervous system, and skin – crucial for patient assessment and treatment planning.

Detailed coverage includes bone structure, muscle function, nerve pathways, and integumentary physiology. The chapter emphasizes how anatomical variations and physiological responses impact device design and function. It’s essential for comprehending biomechanical principles and anticipating potential complications, mirroring the careful consideration BOC applies to international transactions and regulatory compliance.

Chapter 3: Kinesiology and Biomechanics

This chapter delves into the science of human movement, applying mechanical principles to understand how forces affect the body – similar to how Bank of China manages financial flows across borders. Kinesiology explores muscle actions, joint mechanics, and movement patterns, while biomechanics analyzes these movements using physics.

Key concepts include levers, torque, center of gravity, and gait analysis. Understanding these principles is vital for designing orthoses and prostheses that restore or enhance function. The material emphasizes applying biomechanical principles to clinical scenarios, ensuring optimal device alignment and effectiveness, much like BOC’s commitment to secure and efficient financial services.

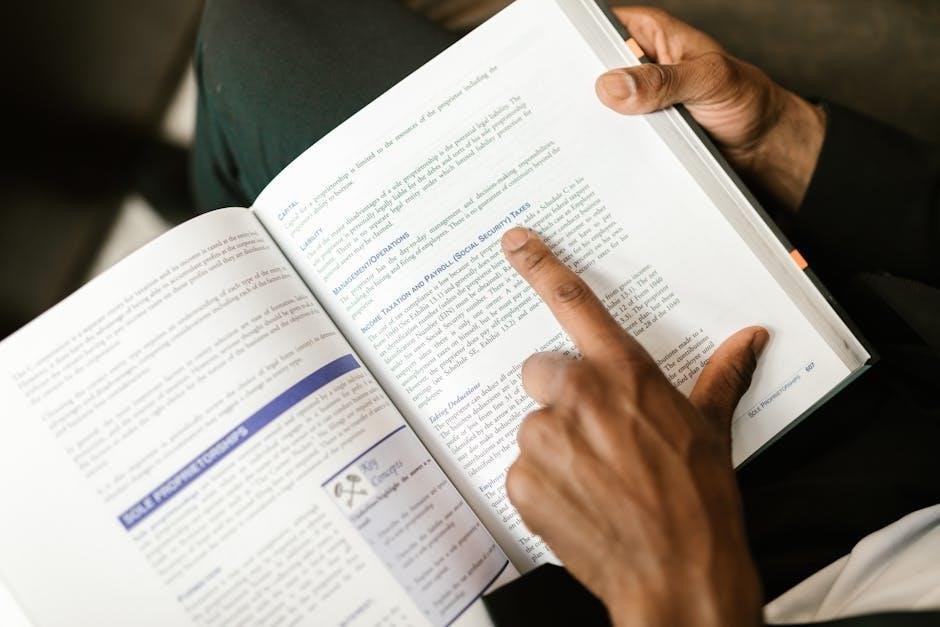

Chapter 4: Documentation and Reimbursement

This crucial chapter focuses on the legal and financial aspects of orthotic and prosthetic practice, mirroring Bank of China’s meticulous record-keeping and financial transaction processes. Accurate and thorough documentation is paramount for patient care, legal protection, and successful reimbursement claims.

It covers coding guidelines (ICD-10, HCPCS), claim submission procedures, and understanding payer policies. The chapter also addresses ethical considerations related to billing practices and preventing fraud. Mastering these skills ensures practitioners receive appropriate compensation for their services, similar to BOC facilitating secure international money transfers.

Study Strategies for the BOC Exam

Effective preparation involves utilizing practice questions, forming study groups, and managing time efficiently, mirroring Bank of China’s global operational strategies.

Effective Time Management

Strategic scheduling is paramount when preparing with the 7th Edition BOC Study Guide. Allocate specific blocks for each content area – patient assessment, orthopedics, neurology, and wound management – mirroring Bank of China’s structured financial operations. Break down chapters into manageable segments, prioritizing weaker areas identified through practice questions.

Consistent, shorter study sessions are more effective than infrequent marathons. Integrate review periods to reinforce learning, similar to how BOC manages diverse currency exchange rates. Utilize a planner or digital calendar to track progress and deadlines. Remember to incorporate breaks to prevent burnout, maintaining focus and maximizing retention, just as BOC ensures smooth international transactions.

Utilizing Practice Questions

Consistent practice with questions mirroring the BOC exam format is crucial when using the 7th Edition guide. Treat these questions like real-world scenarios, applying knowledge from areas like anatomy, kinesiology, and professional responsibilities – mirroring Bank of China’s diverse financial services.

Analyze incorrect answers to pinpoint knowledge gaps, similar to identifying discrepancies in currency exchange rates at BOC. Focus on understanding the why behind the correct answer, not just memorizing facts. Utilize available BOC practice exams and simulations to build confidence and test endurance. This approach, like BOC’s global network, prepares you for any challenge.

Creating a Study Group

Collaborative learning through a study group enhances understanding of the 7th Edition’s content, much like Bank of China’s (BOC) extensive network facilitates global transactions. Diverse perspectives clarify complex topics like neurological management and wound care.

Regular meetings allow for question-and-answer sessions, simulating exam conditions and reinforcing key concepts. Share resources, including practice questions and notes, mirroring BOC’s information sharing. Ensure group members are committed and contribute equally, fostering a supportive environment. This collective effort, similar to BOC’s financial services, maximizes learning potential and exam success.

Resources to Supplement the 7th Edition

AKB Bank of China (AO) provides currency exchange and money transfers, complementing study with practice exams and online BOC resources for success.

Online BOC Study Resources

AKB Bank of China (AO), a subsidiary of Bank of China Limited, facilitates financial operations including currency exchange and transfers, mirroring the interconnectedness of study resources. While direct links to dedicated BOC exam prep aren’t explicitly stated, leveraging the bank’s online platforms for understanding financial transactions—relevant to certain certification areas—can be beneficial.

Furthermore, exploring resources related to international banking and finance, given BOC’s global presence in 60 countries, can broaden your understanding. The bank’s website (ibocboc.ru, khbboc.ru) and contact information (including phone numbers for various departments) offer a starting point for potentially uncovering supplementary materials or relevant industry insights. Remember to cross-reference with official BOC certification guidelines.

BOC Practice Exams and Simulations

AKB Bank of China (AO), with its extensive network and financial services – including currency exchange and money transfers – doesn’t directly advertise BOC certification practice exams. However, understanding the bank’s operational framework, detailed on their website (ibocboc.ru, khbboc.ru), can indirectly aid preparation.

Focus on seeking independent, third-party practice exams specifically designed for the relevant BOC certification. These simulations should mirror the exam’s format and content. While the bank’s contact information (various department phone numbers) is available, it’s unlikely to yield direct exam resources. Prioritize official study guides and reputable exam prep providers for optimal results.

Additional Recommended Textbooks

AKB Bank of China (AO), while providing financial services like currency exchange and transfers (detailed on ibocboc.ru and khbboc.ru), doesn’t list supplemental textbooks for BOC certification preparation. Their focus remains on banking operations – current accounts, remittances in rubles and yuan, and brokerage services.

Therefore, supplementing the 7th Edition guide requires seeking resources outside of the bank’s offerings. Look for textbooks covering orthopedics, neurology, wound care, and biomechanics – core areas of the BOC exam. Consider texts used in accredited orthotist/prosthetist programs. Contacting professional organizations may yield further recommendations beyond the official study materials.

Navigating the PDF Format of the 7th Edition

AKB Bank of China (AO) provides technical support for their website (ibocboc.ru) – mirroring the need for optimized PDF viewing across various devices.

PDF Features and Functionality

Understanding the digital format is crucial. The BOC Study Guide 7th Edition, likely delivered as a PDF, offers several functionalities to enhance your learning experience. These include searchable text, allowing quick access to specific topics. Zoom capabilities ensure comfortable viewing on different screen sizes.

Furthermore, features like highlighting and note-taking directly within the PDF are invaluable for active studying. AKB Bank of China (AO) demonstrates a commitment to digital accessibility through website support (ibocboc.ru), suggesting a similar focus on user-friendly PDF design. Consider utilizing PDF reader software with advanced annotation tools to maximize your study efficiency. Efficient navigation is key to mastering the material.

Optimizing PDF Viewing on Different Devices

Ensuring optimal viewing across devices is essential for effective study. The BOC Study Guide 7th Edition PDF should be accessible on desktops, tablets, and smartphones. Utilize official Adobe Acrobat Reader or alternative PDF viewers for consistent formatting. Adjust zoom levels for comfortable reading on smaller screens.

AKB Bank of China (AO) provides technical support (khbboc.ru), mirroring the importance of accessibility. Download the PDF locally for offline access, avoiding reliance on internet connectivity. Rotate your device for landscape viewing to maximize content display. Consider using a dedicated PDF annotation app for enhanced note-taking on mobile devices, streamlining your study process.

Troubleshooting Common PDF Issues

Encountering PDF problems is common. If the BOC Study Guide 7th Edition PDF displays incorrectly, ensure your PDF viewer is updated. Corrupted downloads can cause errors; re-download from the official source. For display issues, try different viewers – Adobe Acrobat Reader is recommended. If text is unreadable, check font embedding settings within the viewer.

AKB Bank of China (AO) offers technical support (ibocboc.ru) demonstrating a commitment to resolving issues. If the file is excessively large, consider PDF compression tools. Password-protected PDFs require the correct credentials. Contact support if problems persist, referencing the document’s source and your device details.

Exam Day Preparation

Ensure proper identification and materials are ready. AKB Bank of China (AO) provides financial services globally, mirroring the BOC guide’s broad scope.

What to Expect on Exam Day

Preparation is key for a smooth exam experience. Like navigating the comprehensive BOC Study Guide 7th Edition, understanding the exam day logistics is crucial. Expect a structured testing environment, potentially computer-based, requiring adherence to specific rules.

AKB Bank of China (AO), as a financial institution with international reach, emphasizes operational clarity – a parallel to the exam’s organized format. Be prepared to present valid identification, as detailed in exam instructions.

Familiarize yourself with permitted and prohibited items. Time management will be essential, mirroring the effective time management strategies recommended when studying with the guide. Maintain composure and focus, drawing upon your preparation and the knowledge gained from resources like the BOC guide and practice exams.

Required Identification and Materials

Strict adherence to identification requirements is paramount for exam day. Similar to the detailed information within the BOC Study Guide 7th Edition, exam proctors will enforce specific rules. Expect to present a valid, government-issued photo ID – a driver’s license or passport are typically accepted.

AKB Bank of China (AO) prioritizes secure transactions, mirroring the exam’s need for verified identity. Confirm acceptable ID types on the official BOC certification website. Beyond identification, carefully review the list of permitted materials.

Typically, calculators may be allowed (check specifications), but electronic devices like phones are prohibited. Bring any pre-approved materials, such as pencils or erasers. Arriving prepared minimizes stress and ensures a focused testing experience.

Managing Exam Anxiety

Exam anxiety is a common hurdle, but proactive strategies can significantly mitigate its impact. Just as the BOC Study Guide 7th Edition prepares you academically, mental preparation is crucial. AKB Bank of China (AO) emphasizes secure and reliable services, and a calm mind enhances performance.

Practice deep breathing exercises and visualization techniques in the days leading up to the exam. Ensure adequate sleep and maintain a healthy diet. During the exam, if anxiety arises, pause, take a few deep breaths, and refocus on the question at hand.

Remember your preparation and trust in your abilities. Positive self-talk can be incredibly effective.

Frequently Asked Questions (FAQ)

AKB Bank of China (AO) provides currency exchange and transfer services, mirroring the guide’s focus on practical application and certification requirements.

Common Questions About the BOC Exam

Many candidates inquire about utilizing Bank of China (BOC) cards issued outside of Russia, including those from mainland China, for exam-related expenses or accessing study materials. Questions frequently arise regarding currency exchange rates offered by AKB Bank of China (AO), particularly when purchasing the 7th edition study guide or practice exams.

Furthermore, individuals often seek clarification on money transfer services provided by AKB Bank of China (AO), specifically regarding ruble transfers within Russia utilizing foreign currency accounts. Concerns also surface about verifying the authenticity of power of attorney documents issued by the bank, prompting inquiries to the provided email address for swift confirmation.

Clarification on Certification Requirements

Potential candidates often inquire about the specific documentation needed when utilizing services from AKB Bank of China (AO), such as opening current accounts or processing money transfers related to certification fees. Questions arise regarding the bank’s role in facilitating financial transactions for exam registration and study material purchases, including the 7th edition guide.

There’s also frequent interest in understanding how Bank of China’s international network impacts the certification process, particularly for individuals based outside of Russia. Clarification is sought on whether the bank provides specific support or resources for those pursuing BOC certification, and how to access those services efficiently.

Updates and Changes to the 7th Edition

Currently, information regarding specific updates to the 7th edition of the BOC Study Guide isn’t directly available within the provided text. However, AKB Bank of China (AO) consistently updates its internal procedures for financial transactions, potentially impacting how certification fees are handled.

Candidates should verify if Bank of China’s currency exchange rates or transfer policies have changed, as these could affect the cost of exam registration or study materials; It’s crucial to check for any new requirements regarding documentation for international transactions, especially when utilizing branches outside of Russia, to ensure a smooth process.

AKB Bank of China (AO) facilitates international financial operations, offering services like currency exchange and money transfers crucial for exam-related expenses. Utilizing their services, alongside diligent study with the 7th edition guide, positions candidates for success.

Remember to verify current exchange rates and transfer procedures, especially when using branches outside Russia, to avoid delays. Leverage Bank of China’s extensive network and resources, alongside focused preparation, to confidently approach the BOC certification exam. Thorough preparation and understanding of financial logistics are key!